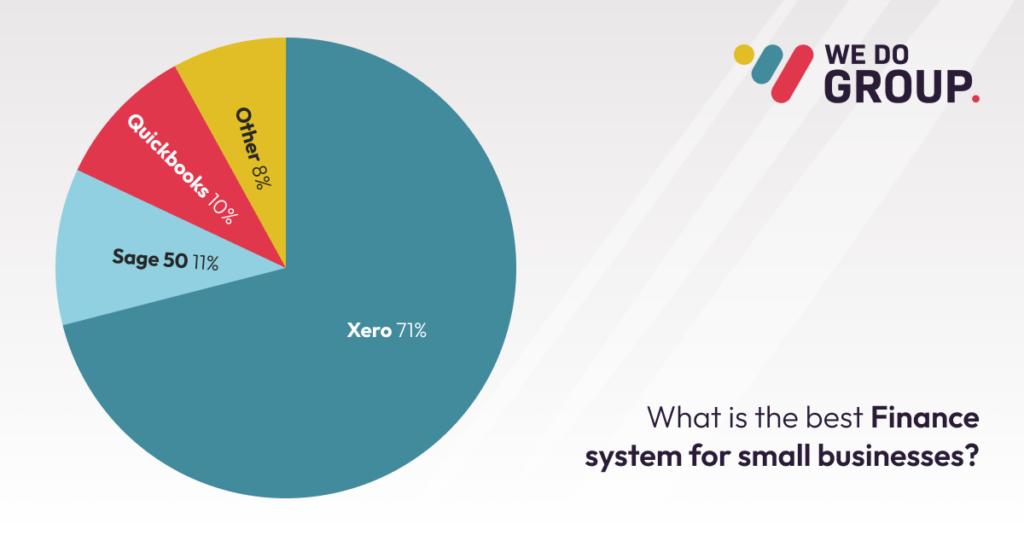

The results from our recent poll are in! We were curious about which finance system small to medium enterprises (SMEs) prefer. So, we turned to our LinkedIn audience for their insights, and here are the results! Xero has decisively outperformed its competitors, collecting a whopping 71% of the votes in our survey aimed at uncovering the most efficient and user-friendly finance tool for businesses.

But why do so many businesses prefer Xero?

User-Friendliness

One thing is clear: business owners love Xero’s ease of use. This system not only simplifies most accounting tasks but also makes managing finances almost a breeze.

Versatility with Apps

Xero isn’t just about basic accounting; its broad range of compatible apps allows it to adapt to various business needs, making it a robust choice for businesses that anticipate changes or growth.

Challenges and Considerations

However, it’s not all smooth sailing. Xero does struggle with period-based transactions, which can often require additional journal postings. For businesses seeking deeper insights, Xero’s basic tools might fall short, pushing them towards Excel or third-party business intelligence tools for enhanced analysis.

Sector-Specific Alternatives

While Xero leads for general use, we shouldn’t overlook sector-specific systems, which offer solutions that better cater to industry-specific tasks. These specialised systems might be a game-changer if your business has unique requirements.

The Future Landscape

The finance system landscape for SMEs is ever-evolving. Larger systems are keen to tap into this market, and interestingly, businesses with turnovers between £10-20 million may find these larger systems more suitable to their needs.

What Do You Think?

As trends shift and businesses like one of our clients move to Xero with a turnover of £13 million, where 98% of candidates supported the move, it raises a discussion about readiness and scalability. So, what do you think? Is Xero still the go-to finance system for your business?

Let us know if you have any more thoughts! Check out the original post and share your views in the comments.